child tax credit november 15

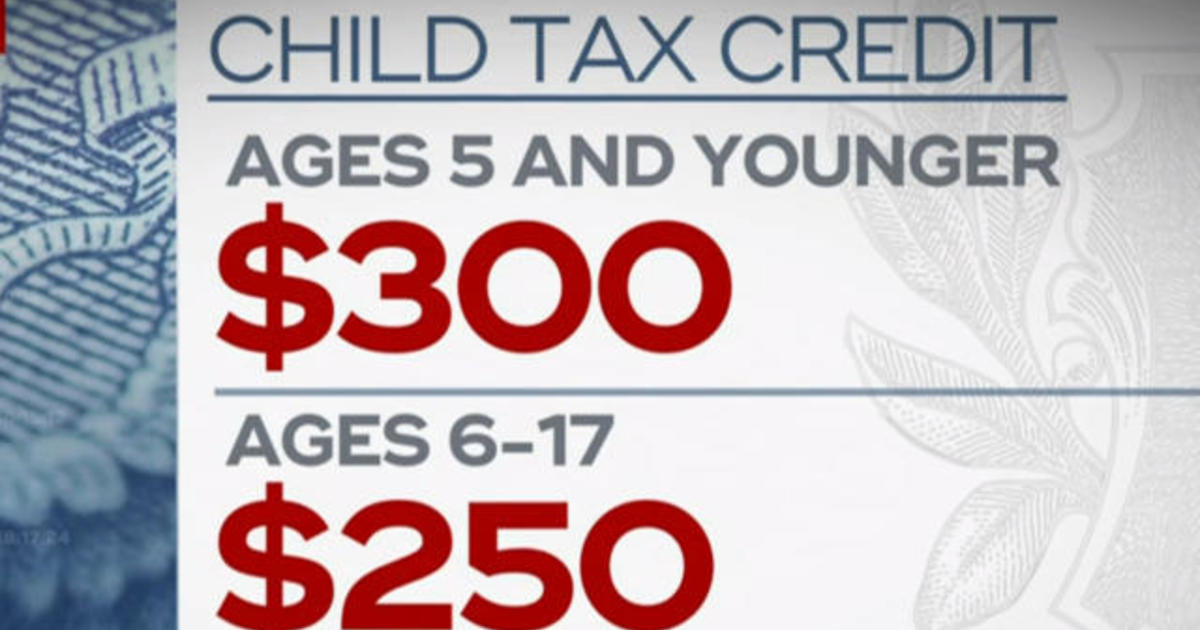

It begins to phase out for single filers at 75000 in annual income for unmarried heads of households at. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Americans have struggled during the pandemic especially people with kids.

. The United States federal child tax credit CTC is a tax credit for parents with dependent childrenFor the year 2021 it is fully-refundable and provides 3600 in annual tax relief for each child under the age of 6 and 3000 for each child between the ages of 6 and 17. Dates for earlier payments are shown in the schedule below. For each child ages 6 to 16 its increased from 2000 to 3000.

Once you unenrolled for one month you did not need to unenroll for subsequent months. To stop advance payments or to make changes to your bank information through the Child Tax Credit Update Portal CTC UP you needed to unenroll or make changes 3 days before the first Thursday of the next month by 1159 pm. The deadline to sign up for monthly Child Tax Credit payments is November 15.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. It also makes 17-year-olds eligible for the 3000 credit. The IRS began disbursing advance Child Tax Credit payments on July 15.

Advance Payment Process of the Child Tax Credit. After that payments were disbursed on a monthly basis through December 2021. The credit increased from 2000 per child in 2020 to 3600 for each child under age 6.

To get money to families sooner the IRS is sending out half of the 2021 Child Tax Credit this year in monthly payments. The Child Tax Credit is here to help. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17 or younger.

For more information regarding how advance Child Tax Credit payments were disbursed see Topic E. Yet Democrats at the time still opted against making the changes to the child tax credit permanent because doing so would have greatly. On Wednesday 15 December the IRS will begin distributing the sixth round of direct payments from the expanded Child Tax Credit the final batch provided for by the American Rescue Plan ARP.

Increased Tax Credits Available In 2021 Health Plan How To Plan Fact Sheet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Don T Miss Out On An Extra 1 800 Per Kid This Tax Season Here S What To Know Cnet

Childctc The Child Tax Credit The White House

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Child Tax Credit Update Next Payment Coming On November 15 Marca

Some Families Will Get 900 Per Child In Child Tax Credits This Month See If You Re Eligible

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

2021 Child Tax Credit Advanced Payment Option Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com