child tax credit payment schedule

What Do I Need. Certified Public Accountants are Ready Now.

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

In 2022 all you needed to do was file Form 1040 which is the United States Individual Tax Return form together with.

. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Besides the July 15 payment payment. Goods and services tax harmonized sales tax GSTHST credit.

The additional child tax credit may give you a refund even if you do not owe any tax. Wait 5 working days from the payment date to contact us. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

From then the schedule of payments will be as follows. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. After that payments will be disbursed on a monthly basis through December 2021.

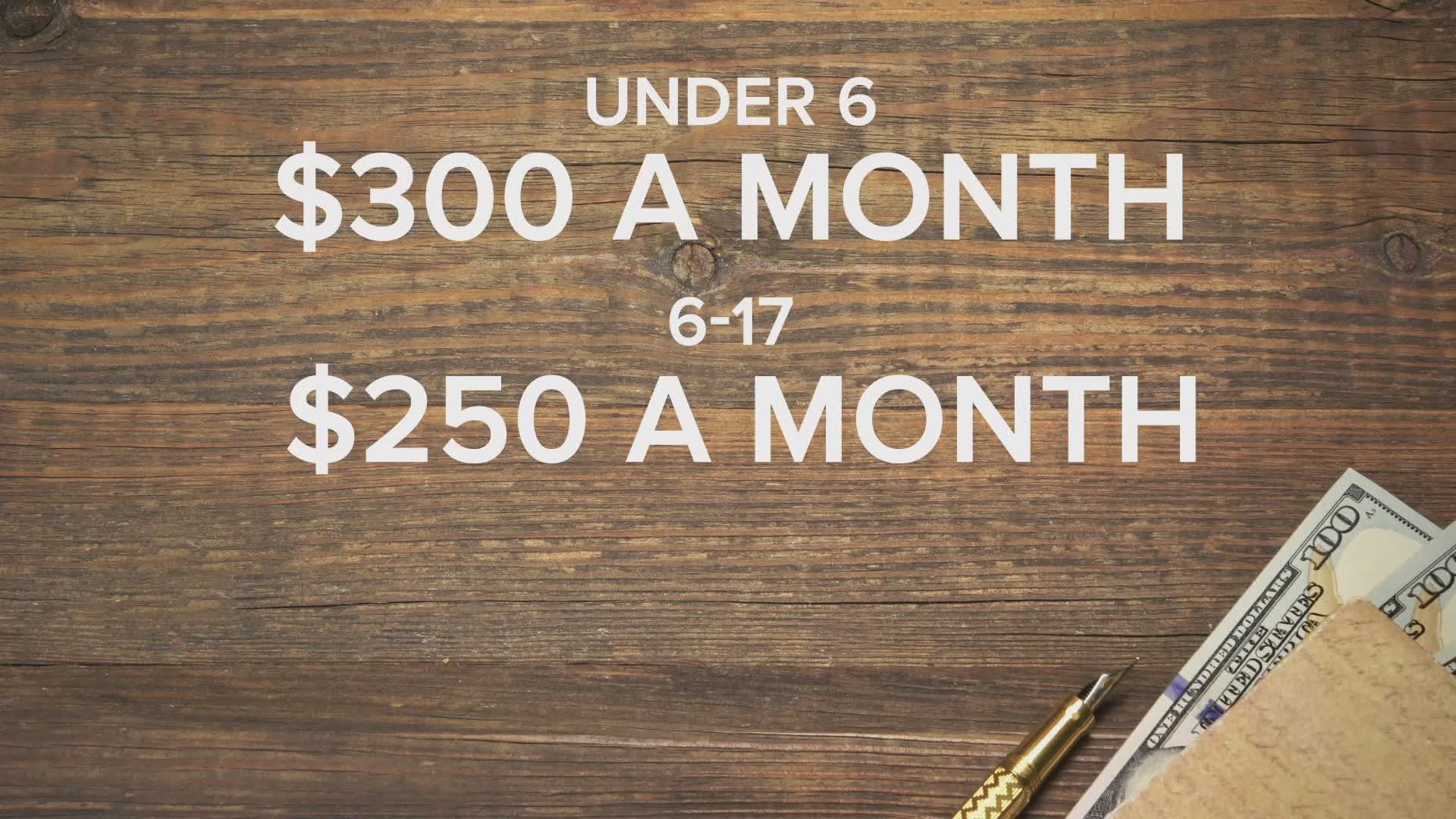

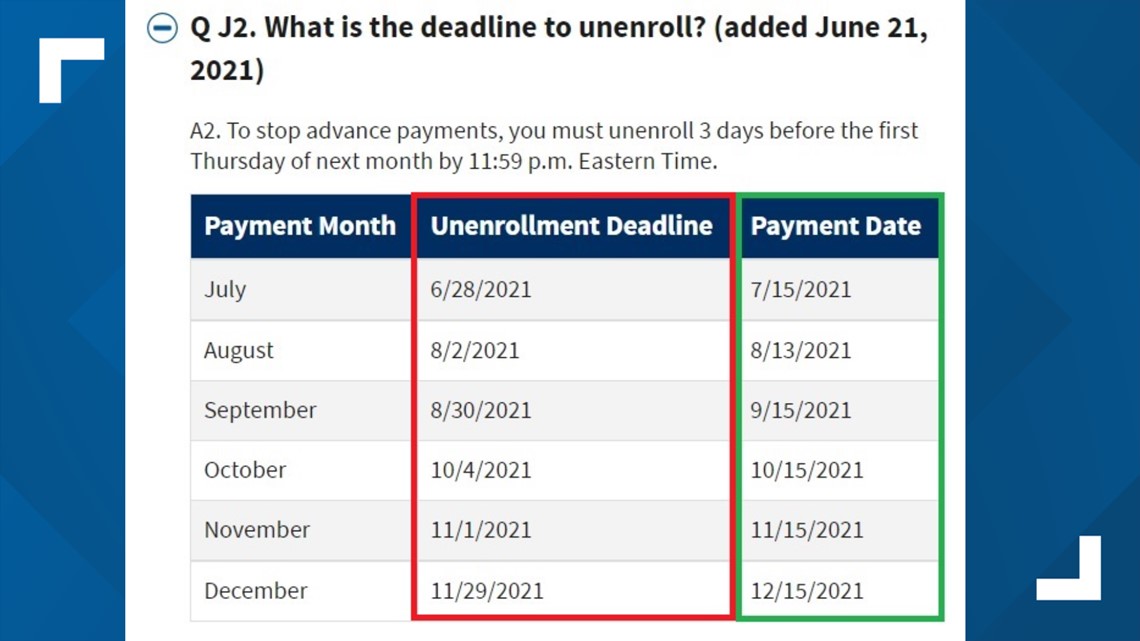

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

The agency says most eligible families. You should receive your first. MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline.

If you do not have a claim form contact HM. The Empire child tax credit in New York offers support to families with. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Within those returns are families who qualified for child tax credits. The credit amount isnt changed so the monthly. The IRS pre-paid half the total credit amount in monthly payments from.

The IRS will begin disbursing advance child tax credit payments July 15. For more information go to CCBYCS payment dates. 2 days agoMonthly child tax credit payments of up to 300 per child ended last year.

To be eligible for the Child Tax Credit you and your spouse if youre married and filing jointly must have a Social Security. You must have an SSN for CTC payment. Ad File a free federal return now to claim your child tax credit.

Ad Get Reliable Answers to Tax Questions Online. What To Do If The IRS Child Tax Credit Portal Isnt Working. 13 opt out by Aug.

While past efforts to renew the policy fell apart theres new optimism something could come together. Includes related provincial and territorial programs. How To Submit CTC.

The schedule of payments moving forward is as follows. While theres no plan to reinstate the child tax credit payments at a federal level there is a Republican Senate proposal that would send up to 350 per child and includes a. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US.

The CCB young child supplement CCBYCS has a different payment schedule. Ad Taxes Can Be Complex. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

That includes an enhanced child tax credit that brought the total sums to 3600 per child under age 6 and 3000 per child under 18 up from 2000 per child. From January to December 2022 taxpayers will continue to receive the advanced child tax credit payments as usual. Individual Income Tax Return and attaching a completed.

The payments for Rhode Islanders come in the form of child tax rebates with a minimum payment of 250 for each eligible child and a maximum of three children totaling. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the. 3 Tax Credits Every Parent Should Know.

Use Schedule 8812 Form 1040 to figure the additional child tax credit. The new advance Child Tax Credit is based on your previously filed tax return. This month Rhode Island families can similarly claim 250 per child and up to 750 for three children.

Tax credit payments are made every week or every 4 weeks. The new advance Child Tax Credit is based on your previously filed tax return. Well how can you claim this credit.

You choose if you want to get paid weekly or every 4 weeks on your claim form. Ad File a free federal return now to claim your child tax credit. 15 opt out by Aug.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

8812104 Form 1040 Schedule 8812 Additional Child Tax Credit Page 1 2 Nelcosolutions Com

Stimulus Update Child Tax Credit Payment Dates Are Changing This Month Nj Com

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

Child Tax Credit Payment Schedule Here S When To Expect Checks Wcnc Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/AFOHQVDJBFEPZOLKB3K4UKEWNY.jpg)

Fact Finders Where S My Child Tax Credit Payment

Advance Child Tax Credit Payments Begin July 15

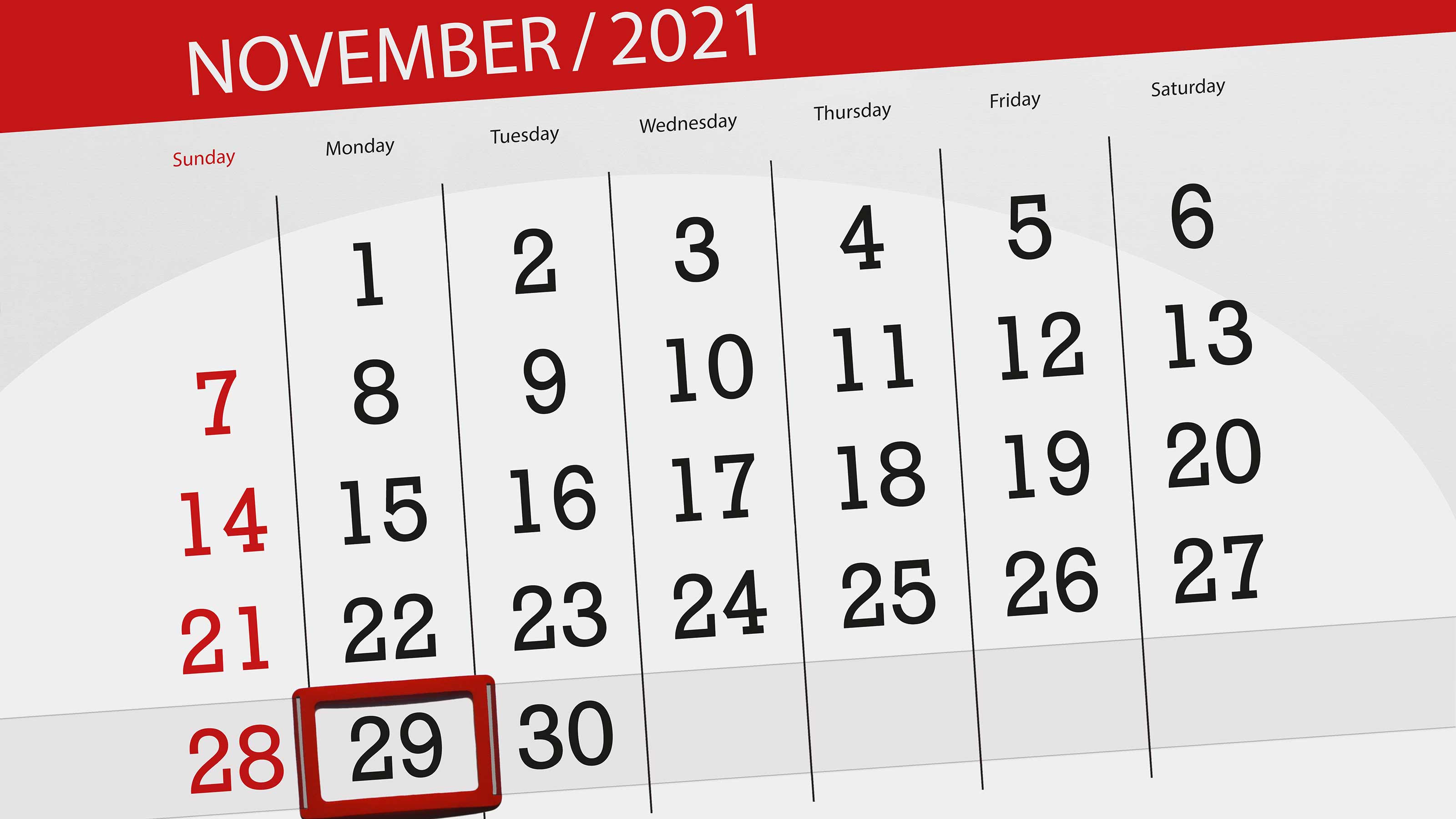

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Payment Schedule Is Out Now Here S When You Ll Get Your Money

Irs Child Tax Credit Scam Arrives As Payouts Hit Bank Accounts

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com